Snapchat continues to resonate with its demographic base.

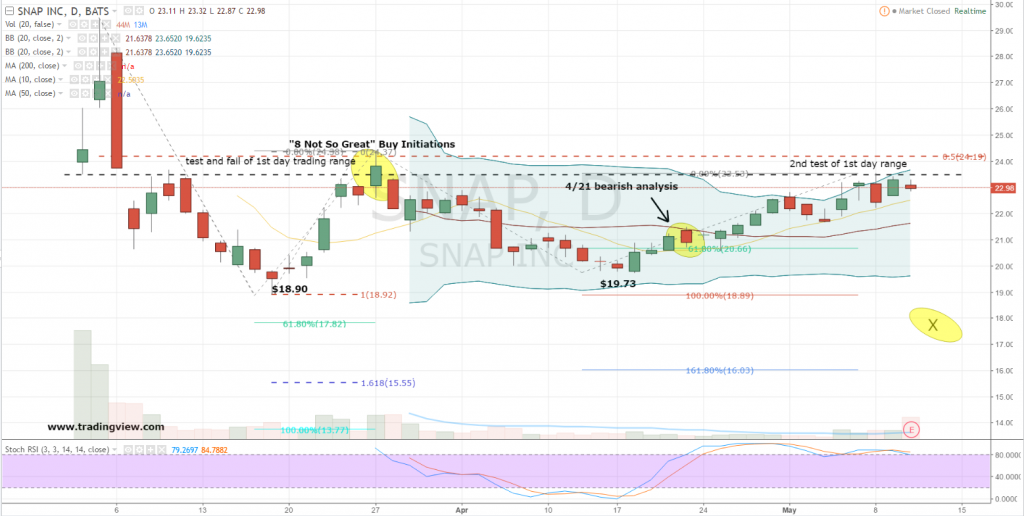

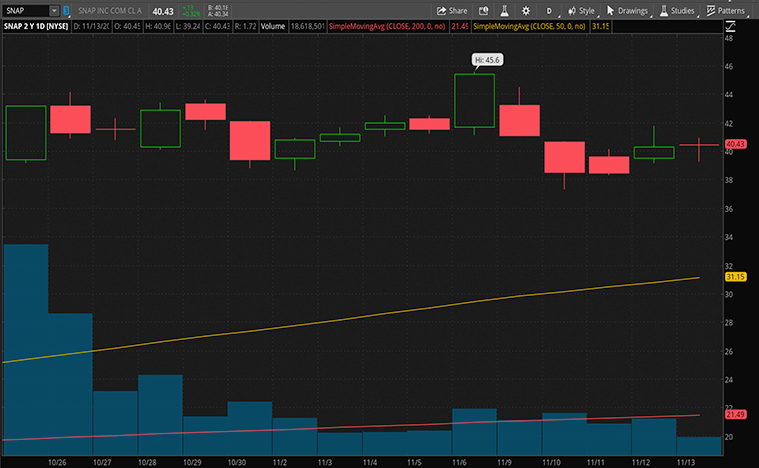

The strong 22% growth in "rest of world" was not nearly enough to offset the growth slowdown in North America and Europe.Ī lone (but important) bright spot was the 19% growth in daily active users ('DAUs'). SNAP has previously guided towards minimal growth and that proved to be the case, with revenues growing by only 6%. Even at these lower valuations, investors should continue to expect high volatility. I last covered SNAP in June and the stock has crashed around 30% since then. The stock has nosedived over the past year. It wasn't too long ago that SNAP had become a sizable social media company. With plenty of cash on the balance sheet to buy valuable time, the stock is highly buyable here. Even with growth coming to a standstill and GAAP profitability still nowhere in sight, the stock is trading at distressed valuations. The fundamentals are showing that advertisers have proven quick to reduce spending on SNAP's platform amidst a weakening economy. After the post-earnings plunge, we are getting that opportunity yet again. In 2021, I remember thinking to myself: why didn't I buy SNAP in 2019 when pessimism was at its peak? The stock would have returned over 10x over that time period. Steve Jennings/Getty Images Entertainment

0 kommentar(er)

0 kommentar(er)